News and Important reads

Discover the diverse career paths available in the financial industry with our comprehensive guide. From investment banking to asset management and private equity, we break down the roles, required skills, salary ranges, and top companies in each field. Whether you're a beginner looking to start your journey or a professional considering a switch, this guide will provide valuable insights to help you navigate your future in finance. Learn about key valuation methods and what it takes to succeed in this dynamic industry. Perfect for aspiring financial professionals and those curious about finance.

Financial career paths, investment banking, asset management, private equity, hedge funds, corporate finance, financial planning, financial industry guide, career in finance, finance job roles.

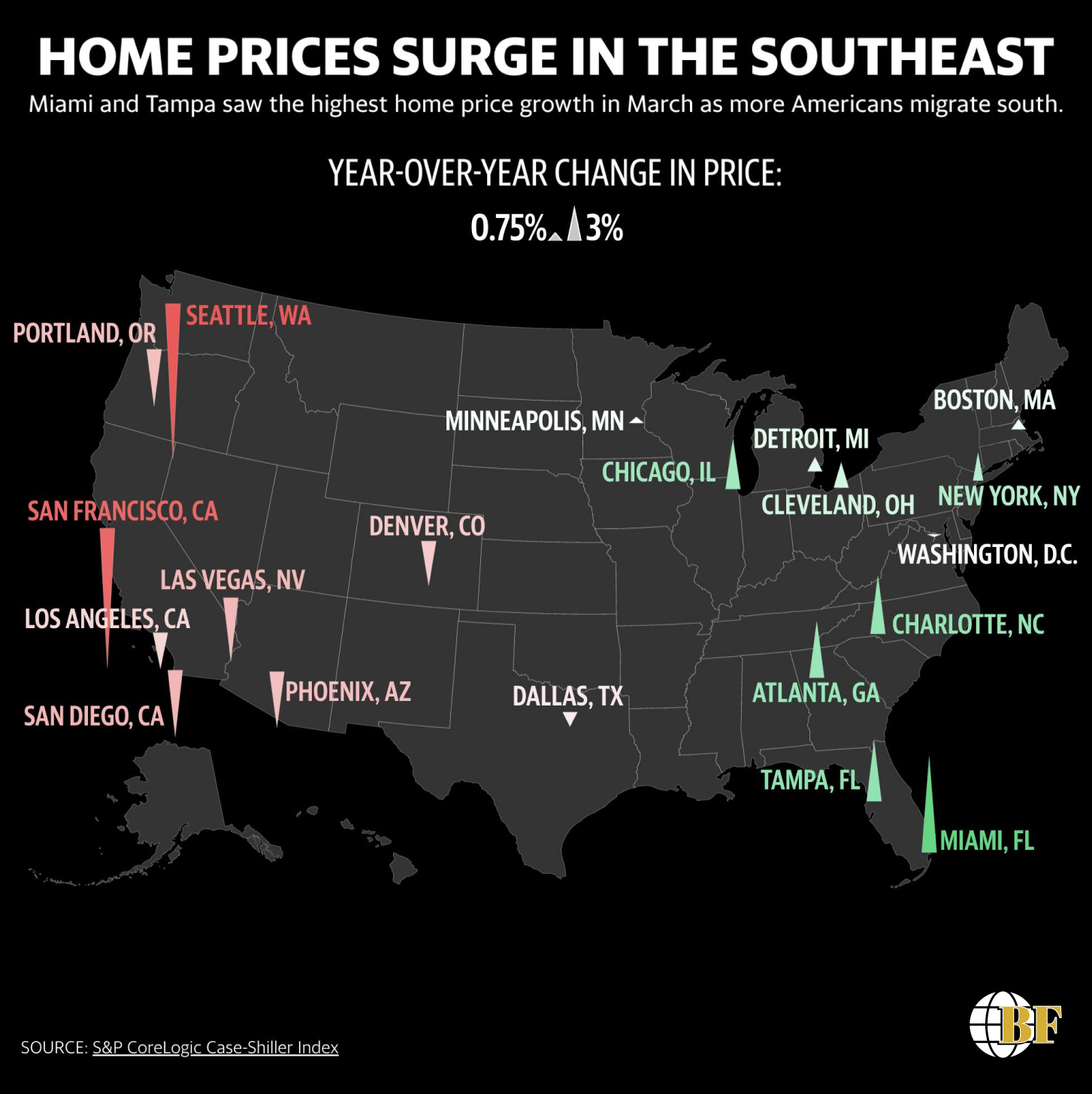

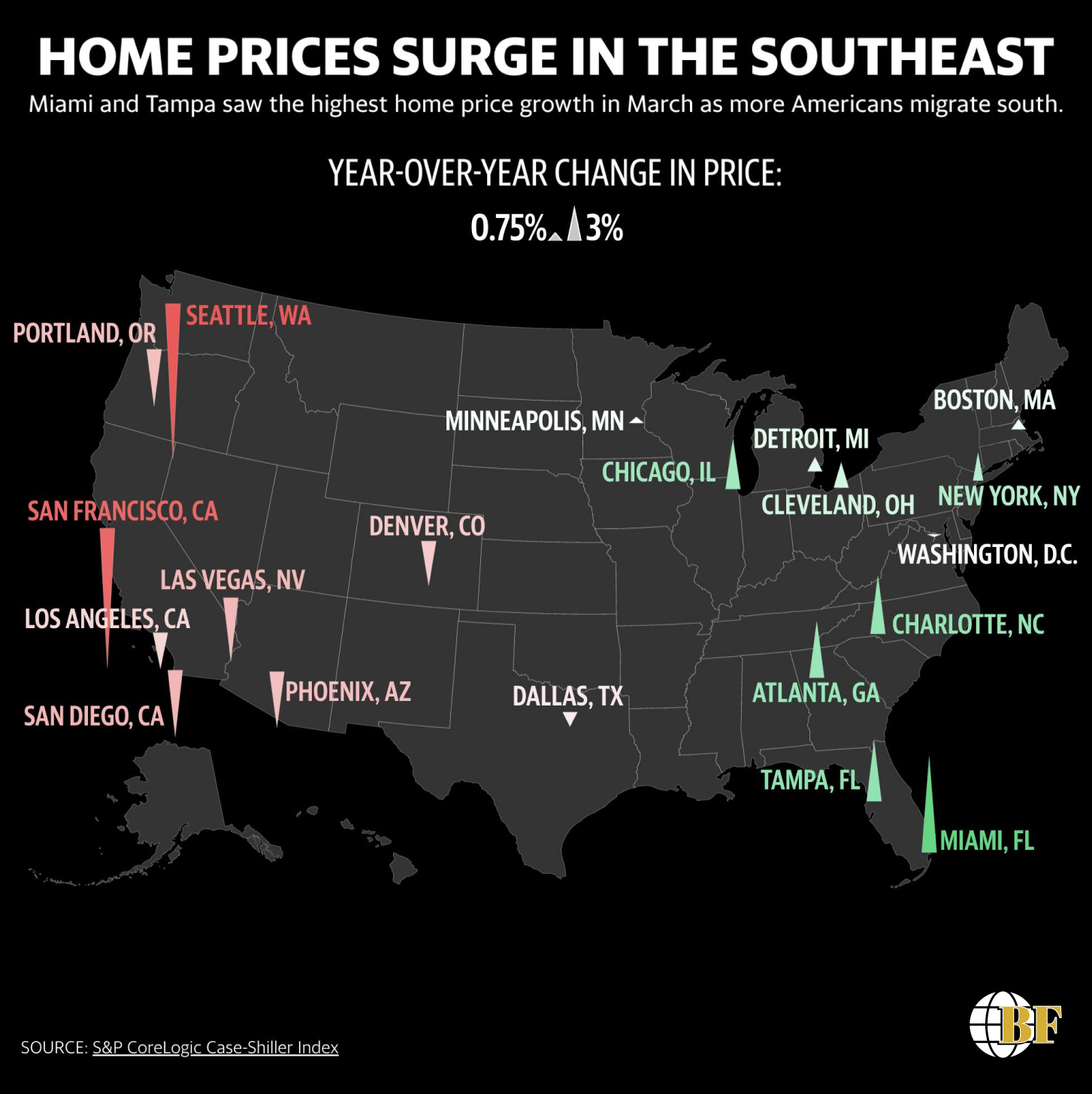

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.

Discover the diverse career paths available in the financial industry with our comprehensive guide. From investment banking to asset management and private equity, we break down the roles, required skills, salary ranges, and top companies in each field. Whether you're a beginner looking to start your journey or a professional considering a switch, this guide will provide valuable insights to help you navigate your future in finance. Learn about key valuation methods and what it takes to succeed in this dynamic industry. Perfect for aspiring financial professionals and those curious about finance.

Financial career paths, investment banking, asset management, private equity, hedge funds, corporate finance, financial planning, financial industry guide, career in finance, finance job roles.

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.