Exploring Financial Career Paths: A Beginner’s Guide

July 16, 2024

The financial industry is vast and varied, offering numerous career paths for those with the right skills and passion.

Exploring Financial Career Paths: A Beginner’s Guide

Investment Banking

What is Investment Banking?

Investment banking involves helping companies raise capital by issuing stocks or bonds and assisting with mergers and acquisitions (M&A). Investment bankers play a crucial role in advising companies on large, complex financial transactions.

Skills Needed:

- Analytical Skills: Ability to analyze financial statements and market trends.

- Financial Modeling: Proficiency in creating financial models to project future financial performance.

- Communication: Strong communication skills to present findings and advise clients.

Career Path:

Start as an analyst, typically for 2-3 years, then move up to associate, vice president, and eventually managing director. Each level comes with increased responsibility and client interaction.

Salary Range:

- Analyst: $85,000 - $150,000

- Associate: $125,000 - $250,000

- Vice President: $200,000 - $400,000

- Managing Director: $300,000 - $1,000,000+

Example Companies:

Goldman Sachs

J.P. Morgan

Morgan Stanley

Asset Management

What is Asset Management?

Asset managers manage investment portfolios on behalf of clients, including individuals and institutions, with the goal of growing their investments.

Skills Needed:

- Market Knowledge: Deep understanding of financial markets and investment strategies.

- Analytical Skills: Ability to analyze investment opportunities and risks.

- Client Management: Strong relationship management skills.

Career Path:

Begin as an analyst, then progress to portfolio manager, and potentially move into senior management roles, overseeing large teams and investment strategies.

Salary Range:

- Analyst: $70,000 - $120,000

- Portfolio Manager: $100,000 - $500,000+

- Senior Management: $200,000 - $1,000,000+

Example Companies:

BlackRock

Vanguard

Fidelity Investments

Private Equity

What is Private Equity?

Private equity professionals invest in private companies, work to improve them, and eventually sell them at a profit. This involves evaluating business performance and strategic planning.

Skills Needed:

- Analytical Skills: Strong ability to evaluate companies and market conditions.

- Strategic Planning: Experience in improving business operations.

- Deal-Making: Proficiency in negotiating and structuring deals.

Career Path:

Often requires prior experience in investment banking or consulting. Start as an analyst or associate, with opportunities to become a principal or partner.

Often requires prior experience in investment banking or consulting. Start as an analyst or associate, with opportunities to become a principal or partner.

Salary Range:

- Analyst/Associate: $100,000 - $150,000

- Vice President: $200,000 - $400,000

- Principal/Partner: $300,000 - $1,000,000+

Example Companies:

The Carlyle Group

KKR & Co.

Blackstone Group

Hedge Funds

What is Hedge Funds?

Hedge funds use various strategies, including short-selling, derivatives, and leverage, to earn high returns on investments.

Skills Needed:

- Financial Expertise: Advanced understanding of financial instruments and markets.

- Quantitative Skills: Strong mathematical and statistical skills.

- Risk Management: Ability to assess and manage investment risks.

Career Path:

Begin as an analyst or trader, with potential to move up to portfolio manager and senior leadership roles based on performance and track record.

Salary Range:

- Analyst/Trader: $100,000 - $200,000

- Portfolio Manager: $200,000 - $1,000,000+

- Senior Management: $500,000 - $2,000,000+

Example Companies:

Bridgewater Associates

Citadel LLC

Two Sigma

Corporate Finance

What is Corporate Finance?

Corporate finance professionals work within companies to manage financial activities, including budgeting, forecasting, and investment decisions.

Skills Needed:

- Financial Planning: Expertise in planning and budgeting.

- Analysis: Strong analytical skills to assess financial performance.

- Strategy: Ability to formulate and implement financial strategies.

Career Path:

Entry-level positions often include financial analyst roles, with opportunities to advance to financial manager, director of finance, and ultimately CFO.

Salary Range:

- Financial Analyst: $60,000 - $90,000

- Financial Manager: $90,000 - $150,000

- CFO: $150,000 - $500,000+

Example Companies:

General Electric

Procter & Gamble

Apple Inc.

Financial Planning and Wealth Management

What is Financial Planning and Wealth Management?

Financial planners and wealth managers provide financial advice to individuals, helping them manage their wealth, plan for retirement, and make wise investments.

Skills Needed:

- Tax Planning: Knowledge of tax laws and planning strategies.

- Investment Strategies: Understanding of various investment vehicles.

- Client Relations: Strong interpersonal skills to build and maintain client relationships.

Career Path:

Start as an associate or planner, with potential to grow into senior advisory roles, managing significant client portfolios.

Salary Range:

- Associate/Planner: $50,000 - $90,000

- Senior Advisor: $90,000 - $200,000+

- Wealth Manager: $100,000 - $500,000+

Example Companies:

Charles Schwab

Merrill Lynch

Edward Jones

Understanding Valuation Methods

Valuation is crucial for making informed investment decisions, buying or selling companies, and financial reporting. Here are some common methods used to determine a company’s value:

- Book Value:

Simple method; subtract liabilities from assets to find value.

- Discounted Cash Flows (DCF):

Estimates value based on future cash flows discounted to present value.

- Market Capitalization:

Value determined by multiplying share price by the number of outstanding shares.

- Enterprise Value:

Combines debt and equity, subtracts cash to determine overall value.

- Comparable Company Analysis:

Compares valuation ratios of similar companies.

- Price-to-Earnings Ratio:

Values a company based on its market price compared to its earnings per share.

Conclusion

The financial industry is vast and varied, offering numerous career paths for those with the right skills and passion. Whether you’re drawn to the fast-paced world of investment banking, the strategic planning in private equity, or the client-focused role of wealth management, there's a place for you in finance. Equip yourself with the necessary skills, understand the different valuation methods, and start your journey towards a rewarding financial career today.The body content of your post goes here. To edit this text, click on it and delete this default text and start typing your own or paste your own from a different source.

Disclaimer:

This article is for informational purposes only and does not constitute professional advice. The companies mentioned as examples are not affiliated with or sponsoring this content. The information provided is intended to offer a general overview of financial career paths and should not be taken as specific advice or guidance. Always conduct your own research and consult with a professional advisor before making any career decisions.

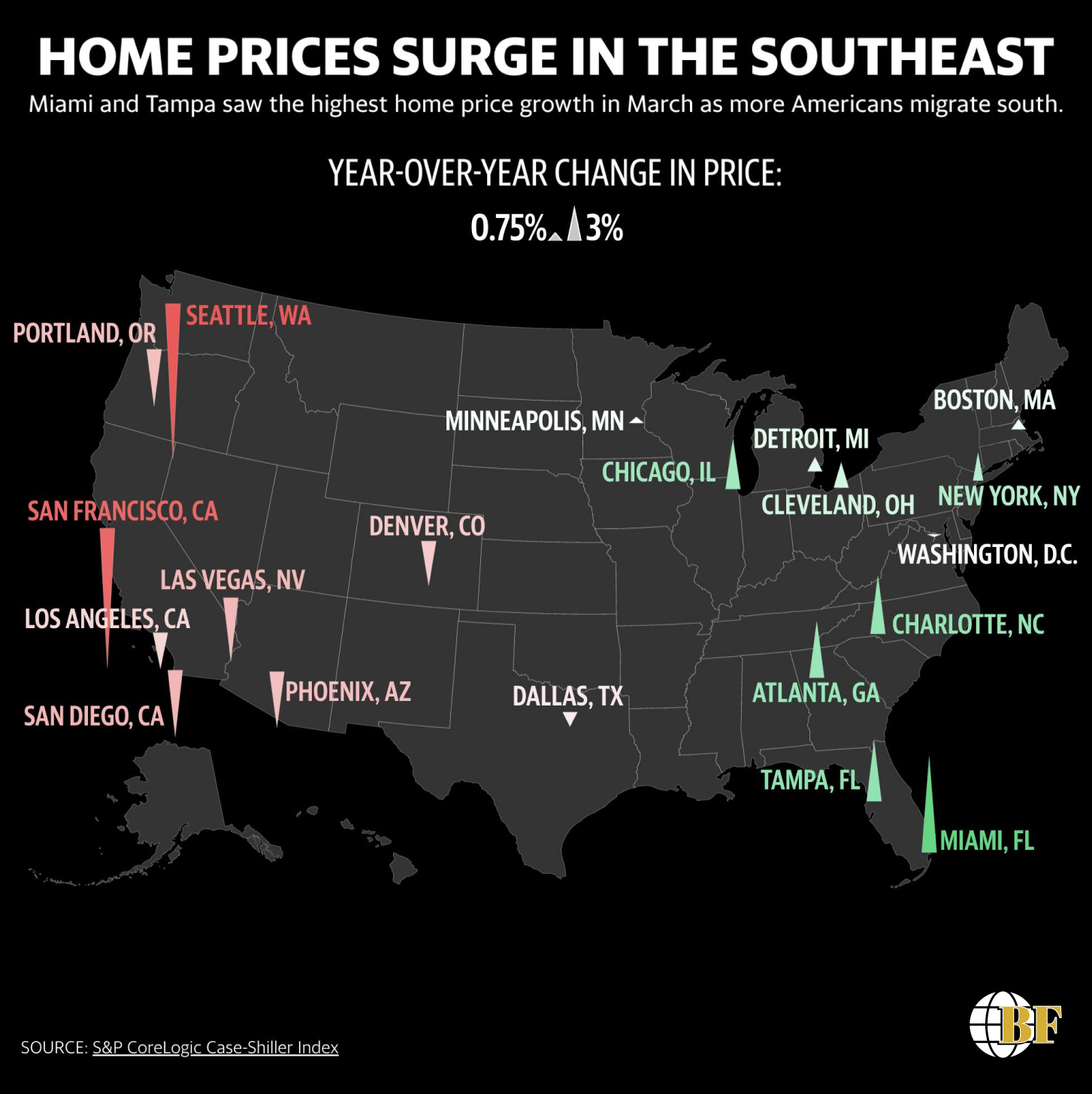

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.